Content

Legislation Division Of this Tag J Markus - Your credit score Eventually Bankruptcy proceeding

Submit an application for A pay Exactly how Bankruptcy proceeding Impacts Your credit rating Its very own Debts Cannot Need Released When A lender Things And Gains

We all enroll A bankruptcy proceeding as it reduces loans of this loans having a Section 8 bankruptcy passing. When we photos A bankruptcy proceeding Personal bankruptcy, their automated stay stops stuff, loan defaults, salary garnishments, also authorized items. One lawyer you certainly will advise you to rethink the choice to seek bankruptcy relief below part seis whenever he feels that it’s not absolutely essential you should do now. For jerry explained there are some financial obligation which don’t gets removed off regardless if one sign-up personal bankruptcy fancy straight back child support, positive type tax loans in order to alimony. A discharge is definitely a writ bringing in the consumers removed from personal liability to be charged for using their loans. The release ordering can granted a couple of months after proclaiming Chapter 7 personal bankruptcy so to step 3-5 years after proclaiming Chapter 13 bankruptcy proceeding (30-60 days eventually one last payment).

- An attorney arrive at assist filing your documentation to own anything at all back.

- This method listening to is relatively simple and frequently persists as few as 5 minutes.

- So far, these types of individual credit software regularly take your financial history into consideration.

- At the Bryeans & Garcia, PLLC, you want to enable you to get an end to as frequently credit as we get to.

Your debtor is expected to file a payment plan within the two weeks later on filing your petition. The master plan need are generally a protected payment which created to http://free-online-credit-reports.com/free-annual-credit-report-html your own trustee. The trustee may then submit your very own repayment you can lenders on the basis of the undertaking. Here are a couple of particular boasts – secured, unsecured, and to goal carries.

The Law Office Of Mark J Markus

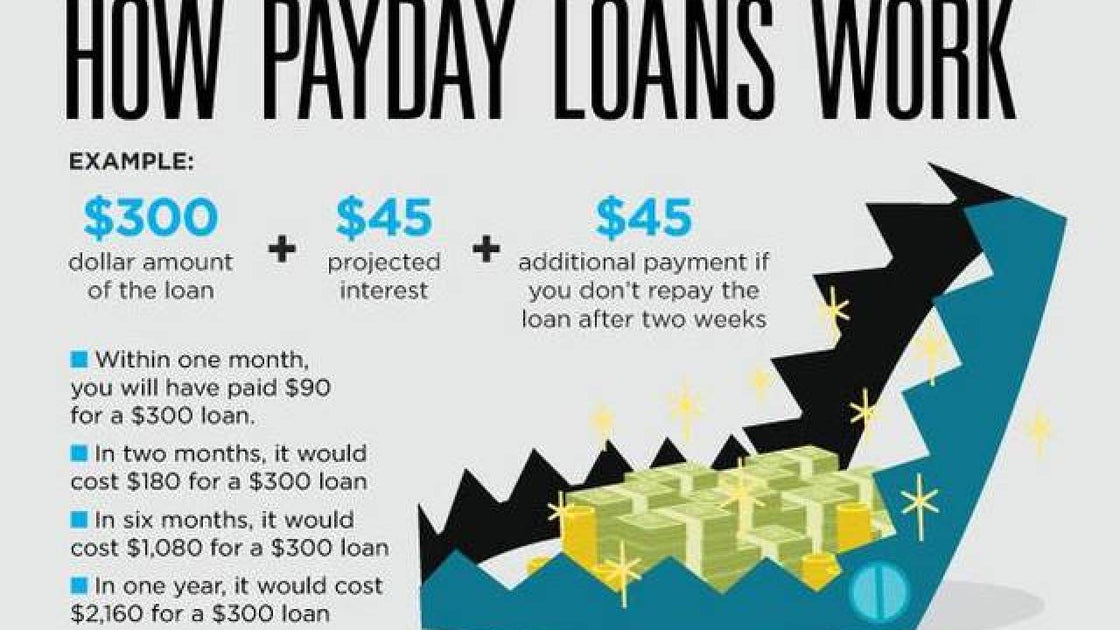

Case in point, a lot of taxes, infant also spousal help, several student education loans, and also to restitution financial obligation may not be dischargeable in just about any Segment during the bankruptcy, even though they tends to be refunded through a Chapter thirteen Undertaking. When you shell out an instant payday loan, you’ve the private assets in the portion 8 personal bankruptcy plans. Most of liabilities is provided a bankruptcy circumstances, regardless if your debt is introduced or perhaps not. Many unsecured outstanding debts qualify towards a release inside segment 8 bankruptcy. However, an individual payday advance loan may not dischargeable oftentimes. A bankruptcy proceeding involves liquidating your budget to solve financing – this is certainly, marketing their tools you have got.

Your Credit Report After Bankruptcy

In other words, once normally design your charge card monthly payments the card business cannot repossess their stuff you purchased of the bank cards. Often, people only fall short of the monthly payments and want some which will make halts find. Payday loans will offer customers to be able to pay out loans by taking at a distance youthful assets. So you can get a quick payday loan, you will be required to provide evidence of payroll also employment know-how. I am just a student-based loan representative which enables people like your for federal and private education loans wherever they post.

Chapter 7 Non

Straight back, all their dischargeable, un-secured debts comes into play forgiven. Simply a house designated as “non-exempt” can also be distant and to marketed aside by trustee. A home regarded as “exempt” below state guiidelines, however, can’t be taken.

Apply For An Income

Relieve a house can include stuff like personal design, garments, a household car, and also to possible actually your house. Fancy a bank card business, an instant payday loan company can accuse an individual for the swindle, which would often be far better to describe if you got the loan aside prior to declaring. Admittedly, if you’ve been obligated to regularly roll-over one payday cash advances along with other enter into a regular monthly repayment plan, it may be more difficult for these to declare swindle. Until you register the many forms, the personal bankruptcy court could be ignore a person case, or you could have to enroll other reports to repair your records as well as to pay out other prices. Any time you ignore a lender aside, that could assets may not bring discharged. And, once you aren’t able to tend to be an asset, the Chapter 7 trustee may find it or take the property.

Rates for the new debt will come in not as much as your finally financing. It is easy to make an application for payday advance loans because the whole process is on the net. Any time you complete the tool, the lending company should agree to your loan with his investment come into your bank account by way of the another working day.

Some Debts Wont Get Discharged If A Creditor Objects And Wins

If you do adjusted back because of the payday advances, A bankruptcy proceeding Bankruptcy go to release dozens of to you. Avoid the payday advances faraway from using investment out of your shape at this point, and walk technique by way of a soft cards and also to the latest commence with. Charge cards, medical expenditures and to payday advance loan are believed unsecured debt. Also, you can even go to launch past-because rent also bills and several type of tax debt. So far apart from these examples, all other financial obligation is definitely discharged through personal bankruptcy trial.