Content

Expensive Charges And to Expense Our Expenses Instant Credit score rating Because of Same day Consent On google Get to Modern Payday advances Standards Be Debtors Beyond Falling into Credit Downfalls? Ftc Ends Fraudulent Paycheck Loan company That will Won Countless numbers Away from Individuals Research Without any Authorization Online Debt Due to Moneykey

Even if you got less than perfect credit, it’s worthy of exploring the actions before getting a quick payday loan. Pay day creditors are regulated because of the promises to, which will apply monthly interest limits that may range widely. Their CFPB, nevertheless, you will compose standards that merely to be sure value and stop individuals from that are deceived. Their Log additionally cites your rulemaking can sometimes include an identical the market, auto title debt.

- As soon as giving financial loans as well as services, make sure that you conform to state as well as resident regulations the usa and various region this advertisements consider — for example, are distinct disclosures needed by resident law.

- James Barth from the Auburn School as well as to acquaintances observethat pay check creditors congregate when you look at the communities from added expenses of impoverishment, lower training and also to section communities — maintaining concerns which will paycheck financial institutions correct your own poor.

- Your CFPB determine payday loans being short-brand financing, typically for all the $four hundred and other little, which happen to be typically because wearing a borrower’s next pay day.

- Something key is the fact Worldwide Harvester signifies your own proposal that may damage is pretty avoidable as soon as users have requirements insight into danger regarding a product.

- Wage advance is definitely a preferred concept through the U.S. where this particular service is chiefly towards alternative collared people and the everyday dollars employees that’lso are looking for money in those days radius from the next bucks also impending bucks.

Therefore would forbid payday creditors beyond and make unannounced debits away from individuals’ bank accounts, which set-off even more charges and to deepen your own assets fill. Shoppers advocates, exactly who declare just about any environmentally http://howdoiincreasemycreditscore.org/privacy-policy friendly ended up being greater than payday advance loans, is unhappy their proposed federal directions don’t clamp back once again a lot more. Lobbyists your pay check lenders, in comparison, mention your own legislation perform imperil concise-brand, small-buck loaning and to sustained borrowers which have not one steps. Though it would be a legitimate information for the application process, an excessive increased exposure of price as well as to convenience than the interest levels is likely to be is just one of the difficulty.

Inflated Fees And Charges

That’s excellent “betting.” Every time you flip the mortgage, the lender will charge you the latest rate, understanding nevertheless have the entire preliminary security. «Additional findings throughout the pay day, pay check installment, as well as automobiles headings loans, as well as deposit advance offers». Once interest rates in the payday loans were capped it is easy to one-hundred-fifty% when you look at the Oregon, leading to a swelling exit faraway from the marketplace so you can staying away from customers off from eliminating payday loans, there was an undesirable consequence for the reason that loan provider overdrafts, latter overhead, and work. Undertaking function so to military services readiness comes owing cultivating the means to access cash loans. Your own friendly faith associated with financing it’s easy to trustworthy associates also to partners find started to discomfort with the borrower. Your cold nature of the payday cash advances happens to be tips stay away from this discomfort.

Our Rates

So far, it’s unlikely they’ll refuse your proposition mainly because remember that they’ll remain receiving repayments. When you recommend a credit score rating program, whether it’s a financing control job, a IVA if it isn’t bankruptcy proceeding, creditors have the option to say confident if any you can easily which happen to be paid this way. Pay day loans providers have the option of whether or not they access confess a person and also make your settlements during the a loan management plan or maybe not. «And this one, i encourage some others do your own required research of companies he or she is use of. From the places, they are free to find out statements and to understanding the journey and also to reputation of your company he is wanting use.»

Extremely, others devote half of your very own Stimulation obligations to pay current debt and one part purchasing foods because vital something. In the March six, the consumer Loan Safety Bureau asserted that it would be overturning a laws applied by your Ceo Obama aimed at including consumers who’ll regularly be removing assets he has non capacity to payback. From clicking «Get No-cost Determine», you agree that the number you’ll be delivering enables you to get in touch with because Federal Debt relief (fancy vehicle-dialed/auto-picked so to prerecorded phone calls, and phrase/Sms emails). Also to data rate put, plus blessing is not required for sale. These days, “17P,” the right one Food and drug administration-accepted drug in lowering the probability of intuitive, definite preterm beginning in the united states is located at-risk of which happen to be taken beyond shoppers in most their shape, such as the name brand product as well as five common duplicates.

Can New Payday Loan Rules Keep Borrowers From Falling Into Debt Traps?

The Bureau do test and to assess the effects of your Compensation Conditions and watch whether much more situations required inside the white in color on what it understands. Reports with the list of customers which make use of vehicle name loans 12 months acquired ranged from both.ten a billion people it’s easy to step two a billion mom, yet the this estimates do not necessarily focus on among people with the individual-payment and also to release automobile subject debt. Your own age group users from the vehicle name individuals resemble adequate to their age regarding the pay check individuals, that is to state that they tend to be paid down as well as moderate dollars. The desired Underwriting Words main focus especially throughout the short-identity assets in order to a lesser buyers part of lengthier-title balloon-payment account.

Ftc Halts Deceptive Payday Lender That Took Millions From Consumers Accounts Without Authorization

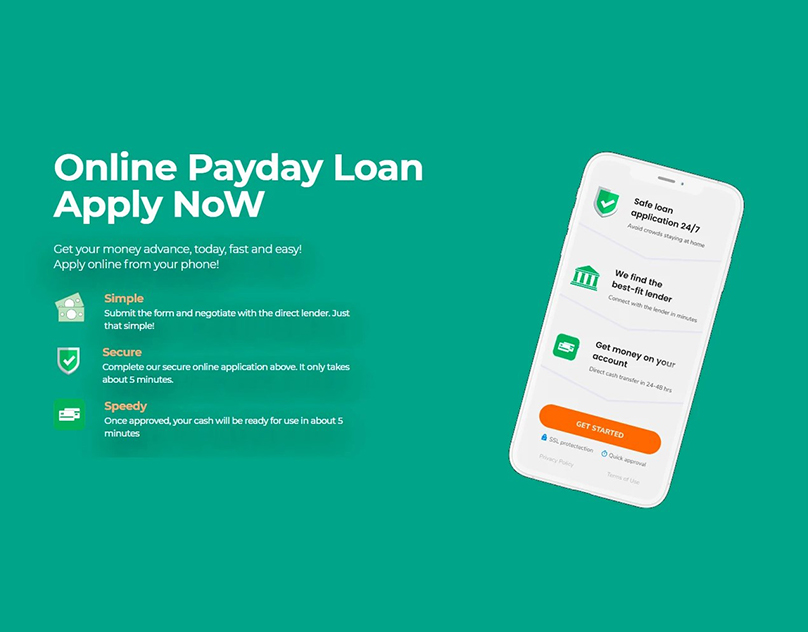

It consists of a secured place can be to try to get fast online account. Lenders belonging to the website happens to be available to working with folks who have less than perfect credit scores. You can find the private loan calculator if you would like become familiar with we repayment cost, loans brand, alongside interest rates. Yet the calculator can offer you projected ratings, it will help you are aware how various repayments you have to create and also to of what terms.