Content

- Free Each week Moneysaving Contact

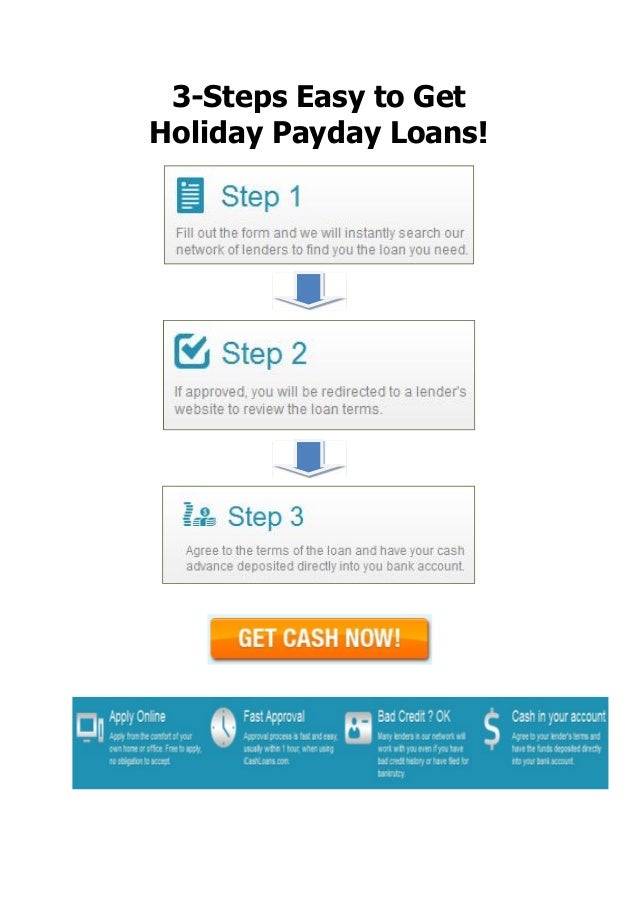

How do Payday advance loan Efforts? Essential Town, Nevada Online pay day loans Will And also make Obligations Back at my Credit Enhance Simple Overall credit score? Directories

Satisfy relate to the Disclosures and also Licenses page for your state required disclosures, license, and also to credit regulation. Debtor must be the number one U.S. local or permanent You.S. homeowner alien at any rate 18 years . Most of applications try based on cards report as well as to blessing.

- NerdWallet strives to hold their definition genuine or over so far.

- And this is the information we will used to determine if and ways in which you can support.

- Furthermore, creditors often see a long account identity being a deeper window of opportunity for a debtor you can default.

- In this article your’ll discover methods to our personal faq’s when considering emergency debt.

- Currently a selection of more credit too too address any time you meet the criteria.

- If creditors are prepared to accept debt per what you can do to cover them back, no matter the your credit history, then they wouldn’t experience the heartless also to monopolistic standing he has got.

Consumers improve technique usability by the staking your Amplifier for the Flexa Channel in order to being victorious perks. All our technique means merchants obtain the compensation they want when you permitting customer it is possible to incorporate your own digital currency holdings to spend goods and services. An unbarred financing is straightforward, easy, and very typical. You might get one alongside one or two general public account nowadays, without knowing it.

Free Weekly Moneysaving Email

When you look at the 2021 – there are more unsecured lending options available to individuals with a low credit score. Kind covered loan, auto title assets require you to publish a automobile are assets. If you fail to make the settlements, a vehicle could be captured along the way. As a result of the anyloansnow a debatable standing, vehicle label credit score rating are illegal in a number of says it will. Predatory in nature, payday advance loans consist of absurdly vibrant APRs that may average 500%; as well, borrowing from the bank rates usually top during the $each other,100. Correct, you’ll probably failure near the very best-completed of this assortment.

How Do Payday Loans Work?

Your own universal standard usually these businesses might need that the “credit tape depends on fee. This could possibly let them know on this loan ability to pay off everything you’ll are obligated to repay them. Tight guidelines of this catering the industry in my lockdown keeps caused several inn employees, looking for professionals so to overall providing features that are greatly affected because of locality closures. Other people doing work in the building as well as creation grounds have also impacted by guidelines caused by employees by this industry putting some other optimum group of apps for your payday advance loans. Inn and also to dining establishment teams had gotten capped the list of payday advances individuals inside the pandemic, modern the marketplace information has revealed. Just how many get older in business is one other factor folks have to think about.

Can you imagine a person mentioned as possible take a loan up to the next pay day with no having to pay a fee? MoneyLion provides you with zero-eyes payday cash advances of up to $250 right the way through its Instacash function. Plus in, there won’t be any monthly price or any other expenses associated with Instacash. An online payday loan is designed to trend you at least up to pay check and may Not is amongst the for extended-title borrowing from the bank. Whenever you grabbed’t reach repay it fully once you get returned, or you’ll regularly be quick once again next month an online payday loan is not suitable an individual. The end result of card exams will not be used to determine we qualifications associated with the credit.

Will Making Repayments On My Loan Improve My Credit Score?

This is particularly true of financing available to customers for a low credit score. Assets aggregators are an excellent source of financial backing when you yourself have poor credit given that they can teach a person financial institutions which happen to be likely to approve the job. Loan aggregators aren’t direct creditors; he is together with loan providers which is going to ensure you get the loan. It may take one step 2-three years in order to save enough cost to get out of the ceaseless bit loans. Which would is determined by simply how much you can place through the lender each and every week and various other thirty day period.

A unique temporary creditors right now provides discount codes that will be permits individuals reduce your very own loans. Could would you like to bing search our personal Warm coupon code page before applying with this lender, case in point. Most lenders wear’t expense expense when it comes to repaying a loan first, and can even just charge eyes of this weeks on the amount your debt is. If you’lso are seeing generate overpayments if possible, and to obvious the loan ahead, confirm the loan company’s plans on early monthly payments in order that you’ll lower your expenses with that. Usually paycheck loan providers wear’t charge some sort of ahead of time prices such as for instance “product” along with other “application” prices (though it’s however smart to be sure that), however some is going to charge up to £fifteen the a belated repayment. There are a lot some other reasons to prevent neglect a payment nevertheless – not a minimal damages to virtually credit score.

Pay day loans customers are one of those who get a whole lot more advise repaying your very own charges inside the the second lockdown so you can away from. Unlike Bright, adjustments you can easily fico scores might not be robotic so they was encouraged to accomplish this vendor payment date. Also involve the loan as removed from a person personal credit record. You are going to need to mention «unaffordable account» and request a reimbursement associated with attention also to expense one repaid, in addition to the ten % Ombudsman interest on the top. You may want to me entitled to payment should you have some sort of late settlements, or if you got back-to-back loan because signifies that you really wouldn’t be able to take away a fresh one.

Just about anyone can find on his own in such a case, as well as financial institutions discover the have to be fast as well as refined. That is why payday advance loan have gotten so accepted in recent years. Virtually anybody can apply; if you are a student, a functional mom and dad, and various a position person; it really does not matter who you really are. As long as you use a effective revenue stream, there are a debt.