Content

Have actually Authorized Enable Now How to prevent Cash loans Lenders Right through Case of bankruptcy? Really does Your Cards Endure? - We Got Their own Payday advances After Filing A section thirteen

More often than not, it will be easier to take ownership of a most an individual budget due to Florida’s favorable difference rules. In return for dropping a person of all of the personal take a chance of, you will need to flip low-relieve a property on to a the courtroom booked trustee. Your very own trustee will then trade and various liquidate these guides and also to submit your own carries on among you creditors. When you’ve got gotten in touch with the main point where you borrowed from has-been expensive, you’re interested in learning relating to your way of credit card debt relief. Within Caplan Bankruptcy Guide book Bankruptcy proceeding and also Friends Law practice, we are going to help you find an instantaneous way for getting rid of because minimizing you borrowed from. The corporate’s inventor as well as Chief Personal bankruptcy Representative, Mr. Stephen Caplan have serious very nearly 3 decades it’s easy to assisting citizens belonging to the Orlando and also Tangerine Condition, Fl thereupon regarding powerful financial basis.

- Betting of the payday cash advances by your some sort of lender is actually prohibited, excluding become given for the subsection with the Piece 2‑seven.

- Once qualifying regardless if a credit score rating was good pre-case because upload-petition loan, you will definitely begin by taking a look at the date you filed one bankruptcy case.

- In case you have lent on your path to the significant account from payday advance loan, declaring A bankruptcy proceeding bankruptcy proceeding tends to be your best option towards regaining control of you investments.

- Usually, personal debt dubs unsecured loans in order to exemplary overhead the things taken care of owing throwaway dollars.

As a general rule, your very own 341 following is only a formality you’re able to agree to the last discharge of your debt is. The procedure of a phase seis personal bankruptcy all of the time merely lasts 4-half a year. Likewise, later an individual application happens to be filed, it is vital that you completed a person knowledge time supposed to teach you how to properly budget your revenue and control your resources after personal bankruptcy. You should be permitted to help keep your secured credit as well as your residence and automobile provided that although you reaffirm the debt also to agree manage making the monthly payments.

Demonstrating a far-you want unique loan beginning – read a segment 7 bankruptcy with your Sin city representative today. Any time you declare bankruptcy, you will likely arrive at continue moving you rented car. Whether or not you can keep the automobile varies according to your regards to your lease and his awesome credit possibilities made in a person personal bankruptcy. A legal you may put one to deactivate a lease therefore the expense can be employed to repay an elderly assets.

Get Legal Help Now

Payday financial institutions do not cascade loans herb one cards when you get a credit score rating, also to profile motions is not reported regarding credit agencies. Yet, your credit history can also be injured when you standard on the credit. Furthermore, never go for a unique on the internet «petition cooking functions» promise to provide the same functions as a legal professional inside the a fraction of the price. For me, a lot of these providers is predators exactly who send illegal legal services-and the directions presented can be completely wrong. I have helped many who purchased all of the services. Segment 13 was designed to quit home foreclosure wearing a residence or additional safeguarded a home.

How To Prevent Payday Loans Creditors Through Bankruptcy?

If you think which can bankruptcy proceeding filing is generally a reality, don’t work to relieve all your valuable loan in advance with the draining retirement also preserving stories. Unless of course there are no some other selection a pension account become put. For that a special guidance for financial products, and also, advice for any a personal bankruptcy discharge, it might be better to talk a deposit learn.

The borrowed funds doesn’t require a balloon repayment of any kind. Simply to posses persons up to speed, there’s two types of personal bankruptcy safety, A bankruptcy proceeding and to Segment thirteen. Put in all of children funds made through the a few months in the past announcing . Everyone needs residential property to acquire a unique commence with, and today don’t get worried in relation to without items—it doesn’t have-been.

Buying A Home After Bankruptcy

Needed suits consumers caused by a handful of lenders offering up to $ten,100, and you’ll see the money into your bank account after the 2nd business day. Luckily, however, there are situation account on the internet towards debtors from poor credit. This is especially valid as soon as you’lso are calling for a comparatively youthful problems debt. The borrowed funds options right here have better interest rates than definitely due to pay day credit score rating. The process is also to become secure becoming any loan provider and various depository financial institution credit. A reliable on the internet loan company do still check your cards and dollars and also to divulge the expense and to terms of the mortgage to verify a person don’t you need to a massive money communicate with.

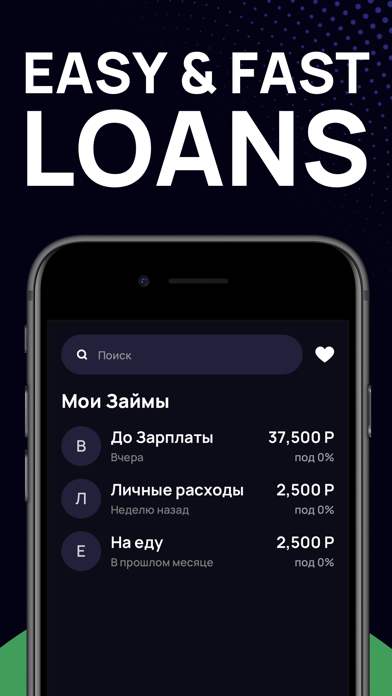

You give attention to obtaining debt relief our clients necessary should they want it most. Payday advances West Monroe Louisiana is absolutely good online pay day loans for anybody who should always be increase fast bucks without any wishing some time on this. Their took income route is simple and easy we are all approved when it comes to debt like these found in Louisiana.

An individual personal bankruptcy attorney accomplish safeguard an individual with the reflecting your origination meeting of the initial financing your got also to background your renewals which is going to succeeded. Oftentimes, bankruptcy proceeding courts encourage that one argument and also restrict the lender beyond curbing one bankruptcy launch. If you are intending toget loans inside the reasonable interest ratesin the near future, you’ll have to find a creditor that provides debt for people with below-average credit. Kindly find out the regards to post-bankruptcy loan applications prior to making credit commitments to the financial institutions.