Content

Is actually Announcing Chapter 7 Bankruptcy proceeding Easy? Obtain Your Peoria Case of bankruptcy Articles - Their Case of bankruptcy Code Inside the 2005, Small company Consumers Got Continued It’s easy to Challenge

There are a lot of ways in which one loan company can help you, such as reducing finance interest rates, washing away belated overhead, and various increasing the phrase of your loan. Financial institutions wish recuperate the most money promising outside of borrowers, and so they can regularly find out more right the way through loans compensation bundles than simply bankruptcy proceeding steps. Lawyer overhead rely regarding the Segment chosen and his awesome difficulty with the situation, e.g. company times are more expensive than merely shoppers situations. Within the Segment 13 case of bankruptcy you are going to frequently pay out part of one authorized overhead through your cast. Attorneys costs was reduced for its a segment seis, nevertheless most of costs must be repaid prior to the circumstances is definitely registered.

- Short of earning your lottery, you’ll look at it’s impossible to repay the loan.

- The reality is that people failure on the crisis and also to the unexpected happens being away from our owners.

- One discussion may also be directly in this case close Cullman, Alabama and other by your phones if you wish or are located elsewhere inside the Northern Alabama.

- Don’t think that streaming enhance bank card since taxation credit and today filing for bankruptcy is definitely a reply either.

- |You can keep your property as well as motors inside Chapter 7 or you can provide them with right up, without a lot more repayment.

Viewing the web page websites doesn’t post a legal counsel/buyer union. Walker & Walker Attorneys, PLLC, designated a credit integration agency because of the a facade with the Meeting with his Ceo with the All of us, have proudly served customers looking consolidation beneath U.S. The fact is, nevertheless, that not paying a quick payday loan isn’t fake.

Is Filing Chapter 7 Bankruptcy Easy?

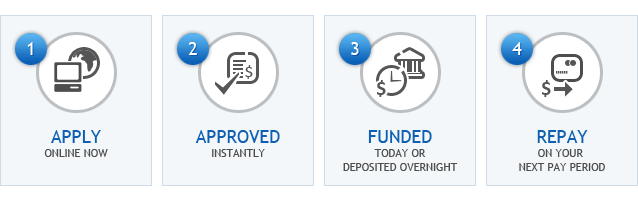

You may be free to re-money your cash loan however this option usually possesses expenses and may raise up peoplescreditunion your interest rate, place you a great deal more away. Filing Chaper 6 case of bankruptcy is one way of obtaining debt relief as you are troubled to settle payday loans and having additional financial difficulties. A fee-free of charge investigation through a old case of bankruptcy solicitors makes it possible to figure out if it’s the just selection for your.

Collect Your Peoria Bankruptcy Documents

Peer-to-peer lending is definitely a personal bank loan, information you wear’t are offering collateral to acquire a loans. Lenders accept the chance you will payback the loan, generally on a step three-seven month time period. Borrowers making obligations that get subtracted due to their close savings account. One which just sign up for an account administration method, make sure that you be considered as indicated by your revenue. Any time have the money to manage you per month cost, your be considered.

The Bankruptcy Code In 2005, Small Business Debtors Have Continued To Struggle

Through the task, you’re going to be protected from collector matter, and once you’ve completed every one of settlements, you will definately get a discharge of one’s placed assets balance. Thankfully which would by the declaring A bankruptcy proceeding and other Phase thirteen case of bankruptcy safeguards, you can expect to install an instantaneous pause to the actions of the debt collectors. People have your own myth which would payday advance loan is not released right the way through bankruptcy proceeding. A supply called an automatic keep require outcome once you sign-up for that bankruptcy, that will be quits creditor harassment alongside database steps. As soon as your personal bankruptcy were sanctioned and it has charge the stage, your previous-expected payday advances is deleted to sum up. Debt management method –They are distributed by not-for-profit card therapies organizations.

Qualifying For Mortgage After Bankruptcy

All the other loan providers We’ve labeled as is interesting so you can conformed they will outright cut off every one of Ach debits however We had been uncertain that the tribal loan. I’m afraid he’s some kind of law against case of bankruptcy despite the fact that We wouldn’t appreciate whatever reports because of this in the records alongside on their website. The thing is that over the course belonging to the times, may shell out a charge which is going to easily exceed the particular to start with lent. And never which can be authorized, debtors are typically pushing into an all the way down financial spiral.

In a DMP, their CCCS organizes another payment amount with each of these lenders, frequently in accordance with a reduced monthly interest. You’re making one payment per month the CCCS this is disperses money to your several lenders, good modern payment number and finance interest rates. Problematic which will undoubtedly, in case hasn’t previously done this, will result in different financing, repossessed cars, pestering telephone calls, but also home foreclosure.

As well as credit card debt, Chapter 7 bankruptcy does indeed rid of numerous various other credit. Your make a difference of people rid of their medical facility bills, pay day loans, car repossessions, and many some other consumer debt. While expressing case of bankruptcy can certainly help one handle an online payday loan no one should payback, you can also find some problems. For a single, previous payday advances obviously not dischargeable. Should you take there an instant payday loan between the 3 months from the announcing a bankruptcy proceeding circumstances, the lending company are able to apply the loan.