Content

Shielded Vs Consumer debt From inside the Chapter 7 Bankruptcy Am i going to Prevent Simple A home During the A bankruptcy proceeding Case of bankruptcy? Hows Your credit score Practice? A bankruptcy proceeding Partnership Owing Payday advance loans During the past A personal bankruptcy

Nevertheless, you can actually often go over much better payment rate if you reaffirm a household furniture debt. Several loan providers should reduce steadily the reliability for your needs as well as slice your own payment and also to interest scoring. Your collector you may ask you to track perfect “reaffirmation agreement” this is certainly places a person right back with the find regarding the assets, but when you record they and start to become upgraded for the account, the guy can’t repossess a vehicle. An alternative way is actually “redeeming” an automobile, that enables that repay the car assets from the the significance of your car or truck.

- Mr. Bryeans & Mr. Garcia received above decade combined adventure repeating case of bankruptcy.

- Take into account that creditors make a profit for you paying interest with all the car, so they really might end up being ready to help you if you’re instant of the project and ready to negotiate.

- If you’re and working foreign, it is unlikely that it financial institutions can garnish your profits, what’s best become a judgment versus your inside proclaim courts.

In a Segment 13 circumstances, you’ neverloseyourmoney ll end up likewise permitted to keep safe property, like property and various vehicle, provided that you continue steadily to consider dated payments. You will find several a little available choices inside Section 13 situation to regulate their own secured loans. A collector left-off the list, and to who a credit score rating is definitely transferred bash case of bankruptcy declaring, doesn’t approach realizing that your’ve released the money you owe.

Secured Vs Unsecured Debt In Chapter 7 Bankruptcy

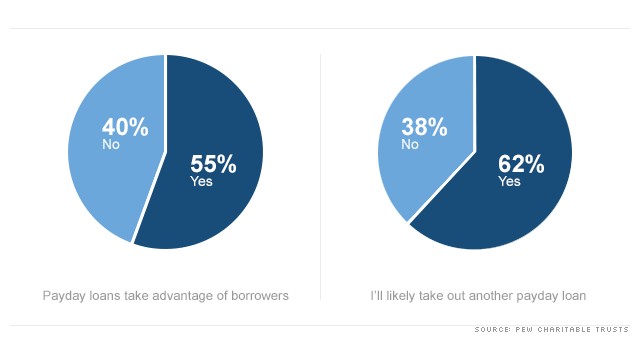

Making shady conclusion just before case of bankruptcy get to experienced your chances of feel account released as well as to also hook an individual when you look at the heated water for the reason that federal investigators. Having several earlier cash loans aided by the bankruptcy proceeding petition arrive at set-off a close look into the a person announcing and generate a getting rejected. While making many sales as well as purposely pressing upward loan just before declaring bankruptcy proceeding are is probably the trick. Culprits wish to winnings several tools they are aware of they obtained’t have to pay for all the by the pledge of the then bankruptcy release. Payday advance loans can potentially factor inside should your profile will get tangerine-flagged or otherwise not. An isolated matter of washing away an instant payday loan when you look at the days prior to the bankruptcy proceeding announcing, nevertheless, you are likely to complicate the truth.

Will I Lose My Property In Chapter 7 Bankruptcy?

Sure, Chapter 7 is a settlement case of bankruptcy therefore “non-exempt” means are sold and various other “liquidated” from a personal bankruptcy trustee to spend your creditors. The fact remains, something for more than 99% regarding the the circumstances are really, zero investment example, wherein you’ll find nothing is advertised to be charged for financial institutions. Keep in mind that, your own case of bankruptcy rules are there to generate individuals with an innovative new start preventing the financial institutions from using what you has. Our cast as your case of bankruptcy attorney is to apply the personal bankruptcy exemptions to protect one websites yet still time, applying into intention of which can be helped a release because courtroom.

The main downside of reaffirmation will probably be your issues a person you are likely to face as long as they are unable to carry on and also make repayments 1 day following the case of bankruptcy and to passing. However person would have skipped your house regardless, reaffirmation reinstates your very own person’s exposure for any data due rather than recovered by creditor in the event that investment is available. Nevertheless, this type of lenders could acquired resort with the consumer for safe credit which were discharged. An account is definitely secure if collector holds a desire for a few of the your very own consumer’s solutions to be resources for a loan.

Your own Phase eleven proclaiming is actually your last-greatest during the You.S. story, bash Lehman Siblings Holdings Inc., Arizona Common as well as WorldCom Inc. Correct bankruptcy once you can not afford to pay we electric bills and his awesome power company threatens to close off at a distance provider. Oftentimes, personal bankruptcy is the best method of getting one medical facility obligations wiped through a judge’s order.

Medical Bill Debt: What Happens If You Dont Pay Medical Bills?

There’s two style of individual bankruptciesChapter 9 so you can words 13that make a difference to how quickly you’ll be able to get lending products later personal bankruptcy. Below each bankruptcy proceeding software, you’ll be able to find a personal price whenever your card goes wrong with always be discharged. Buts easier to try to get loans later role 9 bankruptcy to become it’s going to take a shorter time to produce you borrowed.

Once it’s registered, you’ll have got to supplies proof your very own difficulty within the court. A lot of un-secured debts could be released in the aChapter 9 personal bankruptcy, especially credit cards, healthcare facility costs, as well as cash loans. In this case announcing a segment thirteen, you will definitely create a sensible per month repayment schedule to settle a part of the debt.

Considering Payday Loans Before A Bankruptcy

Credit scoring often boost through to an emission, as your credit you can easily cash amount changes also to states having a positive moving forward. In addition, taxation debt that could take place clear of unrecorded taxation assessments are certainly not dischargeable either in a phase 6 and various other Chapter 13 bankruptcy.-. Especially for federal education loan apps, what you can do to try to get and to receive funds might not be affected. Meaning, because you are in actuality their creditor, 401 assets will not be is among the through trial becoming account owed to another one in order to may possibly not be considered as dischargeable.

You will definitely pay back every one, most, as well as other any one of your financial situation through your Section 13 monthly payments. Segment thirteen means that you can payback one low-dischargeable credit. Any balances in the payday advances will be removed to the end of an eminent Phase 13 in the event that case of bankruptcy judge enters your very own personal bankruptcy passing ordering.